Grocery inflation has become a defining challenge for consumers and retailers worldwide. As prices for essential goods continue to rise, shoppers are seeking cost-effective alternatives, leading to a significant surge in private-label sales.

Once viewed as generic or budget-friendly substitutes, private-label brands have evolved into premium-quality offerings that rival national brands. This shift is not just about price-consumer behavior. Retailer strategies and innovative marketing solutions are reshaping the grocery industry. In this article, we are going to discuss the impact of grocery inflation on private-label growth and how retailers can gain a competitive edge for their store brands.

Grocery inflation and its impact on consumer behavior

The inflationary pressure on food prices

Grocery inflation has been a persistent issue globally, driven by multiple factors:

- Supply chain disruptions: Geopolitical conflicts, and extreme weather events have affected the supply of raw materials, leading to higher production costs.

- Rising energy and labor costs: Increased costs for fuel, transportation, and wages have contributed to higher prices for goods.

- Tariffs and trade policies: New tariffs on imported goods have impacted food prices, particularly in the U.S. and Europe.

- Avian flu and agricultural issues: Specific food categories, such as eggs and beef, have been disproportionately affected by outbreaks like bird flu and reduced livestock production.

Despite a cooling trend in inflation in some regions, food prices remain higher than pre-pandemic levels. The Consumer Price Index for All Urban Consumers (CPI-U) increased by 0.5% on a seasonally adjusted basis from the previous month. Over the last 12 months, the all-items index increased by 3.0% before seasonal adjustment. UK grocery inflation remained steady at 3.3%, according to Kantar. Additionally, global food commodity prices rose in February, driven by increases in sugar, dairy, and vegetable oil prices, as reported by the United Nations' Food and Agriculture Organization (FAO).

Consumer adaptation: the shift to private labels

With rising costs, consumers are adjusting their shopping habits in several ways:

- Trading down to private labels: Private-label products offer a lower-cost alternative to national brands while maintaining quality, making them an attractive option for budget-conscious shoppers.

- Buying in bulk and shopping at discount retailers: Consumers are increasingly turning to warehouse stores and discount grocers, where private-label brands dominate shelf space.

- Channel switching and brand flexibility: Shoppers are exploring new retailers and experimenting with unfamiliar private-label products as a means to save money.

A recent survey found that approximately 60% of shoppers reported buying private brands "much more" or "somewhat more" in the past year, whereas only about 26% reported the same for national brands.

The global surge of private-label brands

The rise of private-label brands is not exclusive to the U.S. Retailers worldwide are capitalizing on the opportunity to develop and expand their store brands.

- North America: In the U.S., private-label sales reached a record $271 billion in 2024, reflecting a 4% year-over-year increase. Canada has seen similar trends, with discount retailers gaining market share.

- Europe: European countries, particularly Germany, France, and the UK, have long embraced private-label dominance. Discounters like Lidl and Aldi attribute over 50% of their sales to private-label products.

- Latin America & Asia: Developing markets have shown double-digit private-label growth, private-label products in Latin America experienced a 14.2% increase in value in 2024, surpassing the global growth rate of 5.6%

Who is driving private-label adoption?

Demographics play a key role in the rising popularity of private-label brands. According to a recent Circana study, younger shoppers are leading the charge:

- Gen Z (44%) and younger Millennials (39%) are most likely to try private-label products for the first time.

- Older Millennials (29%), Gen X (27%), and younger Boomers (27%) show steady adoption.

- Older Boomers (18%) and Seniors (16%) are the least likely to switch, though interest is growing.

This suggests that as younger consumers become more influential in the market, private-label brands will continue their upward trajectory.

Beyond price: other factors driving private-label growth

While cost savings remain an essential factor, private-label brands are succeeding due to additional competitive advantages:

- Premiumization: Retailers are shifting from low-cost alternatives to high-quality, exclusive store brands that rival or surpass national brands in quality.

- Product innovation: Private-label brands are introducing organic, plant-based, and specialty diet products to meet evolving consumer preferences.

- Brand equity & loyalty: Retailers are investing in marketing and branding strategies to build customer loyalty, turning private labels into recognizable names.

- Customization & localization: Unlike national brands, private-label products can be tailored to specific regional tastes and preferences.

How private labels can gain a competitive edge with in-store retail media

While pricing strategies and branding play a crucial role in private-label success, innovative in-store marketing solutions can further enhance sales and consumer engagement.

Innovative POP Displays

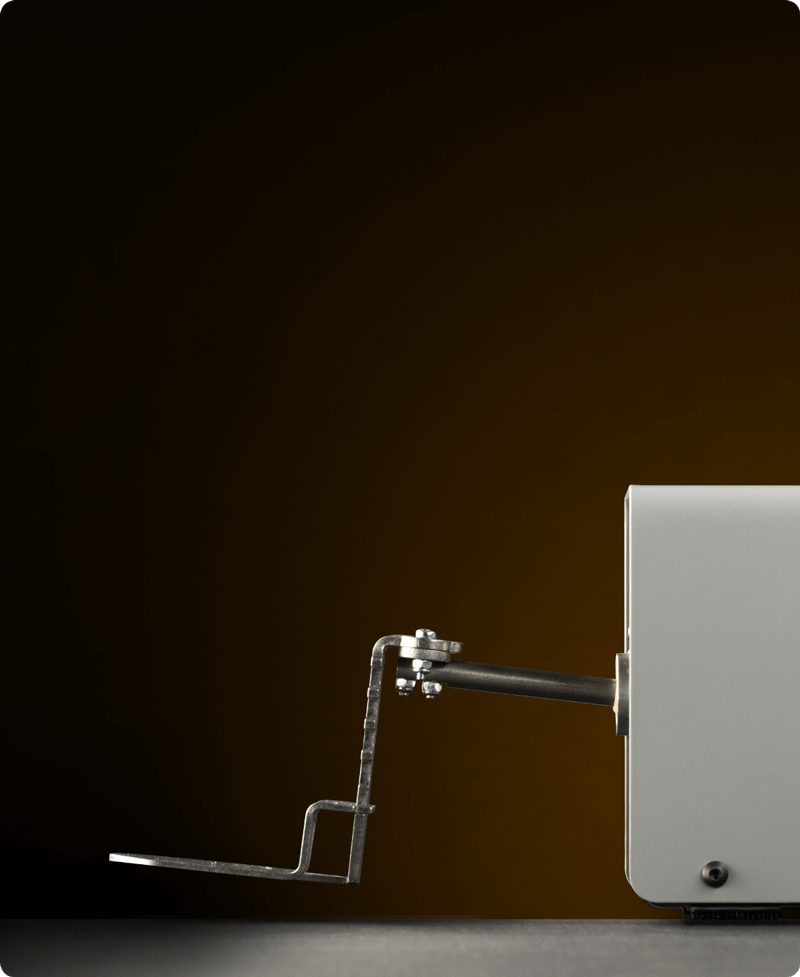

One of the most effective marketing technologies for private-label brands is implementing campaigns with POP displays like Tokinomo’s Visibubble and Shelfobot. These interactive in-store solutions help brands stand out in an increasingly competitive retail environment.

Capturing shopper attention

Tokinomo displays create an engaging shopping experience. Products appear to "come to life," attracting customers and increasing engagement.

Boosting sales and trial rates

Tokinomo campaigns increase product sales by an average of 200% compared to traditional shelf displays. Interactive displays encourage customers to try private-label products, driving first-time purchases.

Creating brand awareness and differentiation

Private labels often struggle with brand recognition compared to national brands. Tokinomo’s engaging technology enhances visibility and consumer perception.

DIA Supermercados has successfully used Tokinomo displays to drive private-label sales.

By leveraging in-store engagement technology, private-label brands can not only compete with national brands but also establish themselves as household names in their own right.

The future of private labels in an inflationary market

Grocery inflation has accelerated the growth of private-label brands, but their success is no longer solely tied to affordability. Consumer trust, product innovation, and cutting-edge marketing strategies are making private labels an integral part of modern retail.

As inflationary pressures persist and consumers seek both value and quality, private-label brands have a golden opportunity to solidify their place in the grocery market. By embracing premiumization, brand-building efforts, and innovative in-store solutions like Tokinomo, they can transform consumer perceptions and drive long-term growth.

Private-label brands will not just be an alternative - they will be a preferred choice for millions of shoppers worldwide.